SBI Debit card EMI on Flipkart

Table of Contents

What is Debit Card EMI?

You can buy high value item even if you don?t have same amount in main account balance in SBI bank. You can pay monthly EMI to your overdraft account in 3,6 and 9 months with 14% interest rate.

There will be no processing fees and you can have one EMI per account, the maximum limit for overdraft is ?75,000. Minimum purchase required is ?5,000 with a single item in a card.

SBI have the largest customer base in India and Flipkart is well known home grown Indian eCommerce website.

Normally EMI can be availed from credit cards and now there are more options for EMI without Credit Card on Flipkart.

How to check my approved limit for Debit Card EMI?

You can check your pre-approved finance limit online.

- Go to this Link SBI-Flipkart

- For Pre-approved Overdraft for e-Commerce purchases on Flipkart enter your Mobile number and account number.

- You will receive OTP, once you enter correct OTP you will get another SMS from SBI stating your Credit Limit.

How to Buy using SBI debit card EMI ?

You can easily buy on debit card EMI following below step-by-step guide.

- Select a product you like to buy View Eligible Products

- Go to the checkout with One item only which is eligible.

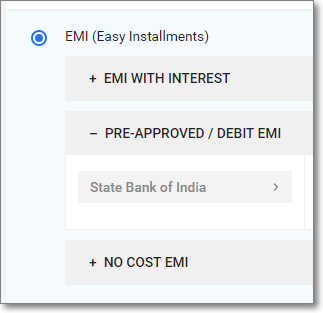

- In Payment section go to EMI (Easy Instalment)

- Select Pre-Approved / Debit EMI

- Follow steps of Debit card and OTP.

- We will add more detailed steps Subscribe to our email news letter and deliver to your inbox.

Things to Remember

- This facility can be availed only 8:00 AM to 8:00 PM

- Valid only on 1 item in cart

- Min ?5,000 and Maximum ?75,000 item

- 3,6 and 9 month emi with 14% interest.

- No cancellation fees up to 30 Days

Detailed Terms and Conditions

-

- The minimum cart amount necessary for availing the Pre-approved EMI is Rs. 5000.

- This option is available in three tenors ? 6 months, 9 months and 12 months.

- The interest will be charged at 14% (fixed) for all tenures.

- The loan is processed as an overdraft (OD) at the bank, which is repayable in equated monthly instalments (EMI). A standing instruction (SI) equivalent to the monthly instalment amount will be set up automatically upon availing this OD.

- The liability to the bank will be extinguished only when the outstanding in the OD account becomes Nil, on payment of residual amount, if any.

Only one OD can be created at any point of time. Multiple ODs are not permitted. - Overdraft account cannot be closed with a residual credit balance in the account. After repayment of exact amount of all dues, the account can be closed through INB.

- No processing fees will be charged.

- Penal interest will not be charged for loans up to Rs 25,000. ? For Loans above Rs 25,000, if the irregularity exceeds EMI, for a period of one month, then penal interest would be charged @2% p.a. (over and above the applicable interest rate) on the overdue amount for the period of default. If part instalment or part EMI remains overdue then penal interest will not be levied.

- All decisions regarding eligibility of the customer as decided by SBI is final.In case account is closed before the quarter end you will not be eligible for taking an OD till next calendar quarter start date.

- Premature closure within one month of availing the OD is not permitted – however, customer can return/cancel the order on Flipkart within 30 days of placing the order without any interest being charged to the customer.

- Any prepayment of EMIs in full or in part and closure of account before the end of term will attract the prepayment charges of 3% on prepaid amount. SI failure will attract penalty of Rs.500.

Last Updated on 28st December 2018 with some details

Top 5 Mobiles available on SBI Debit card EMI