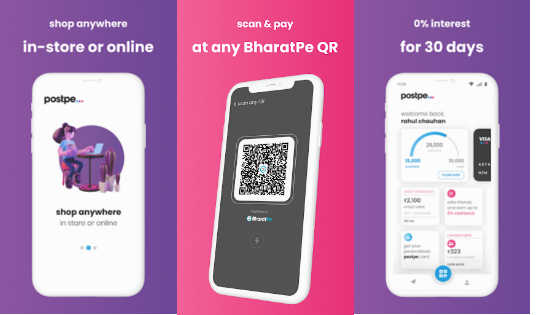

postpe is payment platform you need that lets you shop now and pay next month like LazyPay.

Postpe provides you with an interest-free credit for up to 30 days and an option to convert your bill into low-interest EMIs.

Table of Contents

How to use PostPe?

- Download the postpe app

- Sign up using phone number

- Complete your KYC

- Start buying with ScanQR code.

- Earn up to 5% cashback

How to repay PostPe bill ?

- Every month Bill is generated on the 1st. You can repay within five (5) days of bill generation or convert to EMIs.

- Use UPI app, debit card, and net banking to pay the bill.

PostPe EMI

postpe gives credit line between Rs. 1,000 to Rs. 10,00,000. The interest rates range from 15% to 20% per annum with a loan tenure of 3 to 6 months.

Important Points

- Scan and Pay – Scan QR codes to pay using postpe.

- postpe Card – it can be used anywhere for online and offline shopping.

- Cashbacks and Rewards – Unlock cashback and rewards at multiple places

- Refer and Earn – up to 5% cashback

- Easy EMI – Pay in full or convert to low-interest EMIs

- postpe aggregates all your transactions and generates one bill for repayment next month

- No annual fee

PostPe customer care

If you want to contact postpe support you can email with details about your registered mobile number at [email protected]

Banking partner is SBM Bank, you can contact on website , Customer care email: [email protected]

Toll-free number: 1800 1033 817

Our Lending Partners

Trillionloans Fintech Pvt Ltd

Nodal Officer details:

Mr. Niraj Muraka

E-mail: [email protected]

Contact Number: 022 48904685

Timings for contact: 10AM to 6PM,

Monday to Saturday*

(*Only on Odd Saturdays)

Innofin Solutions Pvt Ltd

Nodal Officer details:

Mr. Pratik Kharel

E-mail: [email protected]

Contact Number: 022 48913091

Timings for contact: 10AM to 6PM,

Monday to Saturday*

(*Only on Odd Saturdays)

Hindon Mercantile Limited

Nodal Officer details:

Ms. Savita Bhogra

E-mail: [email protected]

Contact Number: 01142610483

Timings for contact: 10AM to 6PM,

Monday to Saturday*

(*Only on Odd Saturdays)

L&T Finance Consumer Loans

Head GRO details:

Mr. Vinod Varadan

E-mail: [email protected]

Contact Number: 022 62125237

Timings for contact: 9:30AM to 6:30PM, Monday to Friday

(*GRO office is available on call on all working days)